It can be unnerving to find out that an appraiser thinks the home you want to buy is not worth what you thought it was.

It can be unnerving to find out that an appraiser thinks the home you want to buy is not worth what you thought it was.

Many buyers and sellers have asked me how often an appraisal is low. Fortunately, they are not extremely frequent, but enough that the issue should be on anyone’s radar who is buying or selling.

According to Fannie Mae, it happens around 8 percent of the time. Of course, these figures can vary from year to year. Their report was a while ago, and there hasn’t been more recent reporting.

It will be higher in some years and lower in others.

A low home appraisal can be more than just upsetting. Sometimes, Purchasing your dream home can be impossible unless you are a cash buyer.

A low appraisal can complicate buying, potentially leading to renegotiations, increased down payments, or even transaction cancellation.

Lenders will only give you enough money to buy a home at fair market value. If the appraisal is low, you may have to pay the difference.

Of course, a low appraisal is just as disturbing to a seller. When a low appraisal comes out of the blue, it can frustrate everyone.

Considering the impact a low appraisal can have on home-selling and home-buying, educating yourself on what factors can lead to it happening is a good idea.

What Can You Do When It Happens?

In some circumstances, you may be able to take steps to improve the situation.

In others, you may have to accept defeat. Either way, you will be better prepared to assess a home’s value like an appraiser.

Sometimes, the appraiser is just flat-out wrong. Keep in mind appraisers are not infallible. They are just like the rest of us and make mistakes.

For this reason, it’s a good idea to understand how to dispute a low appraisal when buying or selling a home. Real Estate agents are often put in a position where they need help from a client to challenge a real estate appraisal.

The above reference provides excellent information on what to do if your appraisal is low.

In my thirty-eight years of selling real estate, I have been fortunate to experience only three failing appraisals. In each case, I was able to dispute the appraisers findings and win. There is a high percentage chance an appaiser will not adjust their valuation unless they have made a significant mistake.

How often an appraisal comes in low is often dependant on the real estate market and the parties involved in the transaction.

Interesting Facts and Statistics Worth Knowing

1. Low appraisals occur in a significant number of real estate transactions.

2. The frequency of lower appraisals can vary depending on the market conditions and location.

3. There is no fixed percentage for how often an appraisal is low, as it can fluctuate based on various factors.

4. Low appraisals can lead to challenges in securing financing or negotiating the purchase price.

5. Working with knowledgeable real estate professionals to navigate potential issues related to failing appraisals is essential.

6. Low property appraisals occur in approximately 8%-10% of real estate transactions, which varies yearly.

7. Homes in urban areas are 42% more likely to receive lower-than-expected appraisals.

8. Properties valued at over $1 million have a 13% higher chance of encountering a lower value.

9. The likelihood increases by 27% when the market experiences a downturn.

Potential Factors Leading To A Low Appraisal

1. The House is a Disaster Area.

Appraisers are human, like everyone else, and can be influenced by external factors. You would think that all appraisers are like bean counters who look at a property’s number of rooms, bedrooms, or square footage.

That is not the case. An appraiser will also examine the interior and exterior condition of the property. You can do your part by reading the reference here to prepare your home before the appraiser arrives.

Please don’t make it easy for the appraiser to provide a low real estate value!

If dirty dishes are in the sink, clothes hanging around, an awful smell of cat urine, or any other unpleasant things, don’t assume they won’t affect the appraiser’s value judgment.

Your home should be pristine when the appraiser arrives at your doorstep. Don’t let the appraiser mentally check a box that your home is in terrible shape!

2. Basements Are Calculated Differently.

A home can have an incredibly finished lower level with all the right touches. However, the appraiser will still have to calculate the value of the basement differently than the square footage above ground.

While a nice finished basement can substantially expand a home’s square footage, the value of the basement space will still only be worth a fraction of what similar space upstairs would be.

This is, in fact, one of the more common reasons why an appraisal comes in low. Valuing a basement can often be far more challenging, especially when it has extravagant features such as a home theater, custom bars like those in a restaurant, personal gyms, a gorgeous bedroom suite, and the list goes on.

Quite often, people pour hundreds of thousands of dollars into their basements. That certainly does not mean they will get all the money back when it comes time to sell—in many cases, far from it.

The value will be much higher if the basement is a walk-out with full-size windows. You will likely be over-improving if you have four concrete walls and dump a ton of money into below-grade space.

Real Estate Pros Share Their Experiences

Theresa Wellman is the lead broker for Blossom Valley Realtor and weighs in on this topic:

“Some real estate professionals give way too much credit to a finished basement when there are many other factors to consider when valuing it. Finishes, materials, and building codes all play a role in the value and worth of a finished basement. The term can be so loosely thrown around in the hopes of a higher appraisal value that it can affect the overall personal value of the next buyer.

A finished basement to one homeowner may just mean closed-in walls, while another may have high-end flooring, a wet bar, a game room, built-in speakers or even a media room.

The living situation can also be affected. If the basement houses another full bedroom with proper windows, escape routes and closets rather than just one large room that could be anything, the value will be exponentially higher as it affects the whole house.

Tread lightly with the term “Finished Basement” until you know what you’re getting.”

Conor MacEvilly of Conor Mac Homes shares similar sentiments.

“Bill, it is not uncommon for less experienced real estate agents to over value finished lower level. I see this occuring every so often. Unfortunately, when you can’t place the distinction between upper and lower grade space this happens.

People fall in love with the hot buttons and put too much emphasis on them in their evaluations. Both buyers and sellers, and plenty of agents, can add greater monetary value to certain aspects of a home than a professional appraiser might do.

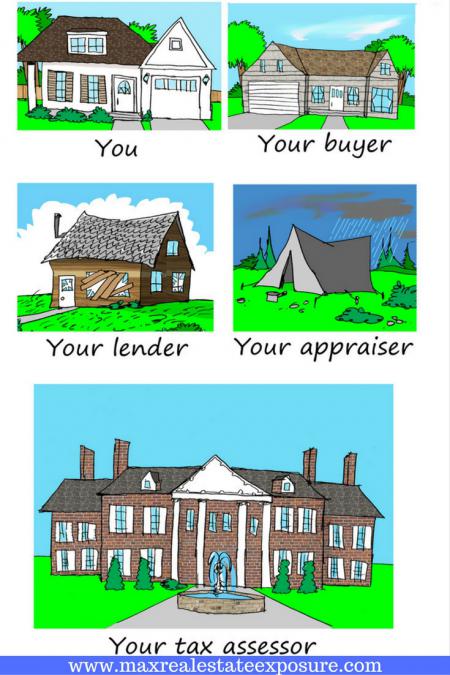

3. The Appraiser Uses Unusually Low Comps.

To calculate the value of a home, appraisers look at nearby homes that recently sold, known as comparable sales or comps.

To calculate the value of a home, appraisers look at nearby homes that recently sold, known as comparable sales or comps.

The appraiser’s comps may have all the same features as the home in question, such as similar size, number of bedrooms, number of bathrooms, etc., but a similar home can sell for lower than normal if there are underlying issues with it.

The home may have had issues with mold or asbestos, for instance. If the appraiser does not look closely at the comp, they could make inaccurate comparisons that damage the appraisal value.

There are an endless number of reasons why something could sell at a lower-than-fair market value. Maybe the seller was transferred and needed an immediate sale. Maybe there was a death in the family, and the heirs wanted to sell quickly.

A couple could also be selling the house during a divorce.

Homeowners might find themselves needing to sell a property swiftly, which may not be directly linked to the general real estate market.

You get the point—there are countless possibilities. The appraiser, however, might just look at the sale price and never consult with the real estate agent who handled the sale.

In such cases, sellers may be motivated to lower prices to attract potential buyers. It is unfortunate when a distressed property is used as a comparable sale, as this can distort the price, but not due to broader market conditions.

4. Improvements Are Not Always as Valuable as You Would Expect.

Home improvements and additions must be similar to other homes in the area to be valued as you would expect. If every house in the neighborhood has a finished basement that costs $40,000, but the home you are looking at has a finished basement that costs $100,000, you will run into problems.

No matter how nice the improvements are, the appraiser will not value them significantly higher than those in the other homes in the area. One of the biggest misconceptions among homeowners is that there is a one-for-one return on home improvements. That is almost never the case.

More often than not, it takes years to get the full cost or more from making improvements.

Some home improvements increase the value far more immediately and long term than others.

5. The Market is Moving Too Quickly.

The #1 reason impacting how often a real estate appraisal comes in low is that real estate marketing is getting ahead of itself. If homes are selling rapidly and at increasing prices in your area, it may be difficult for the appraiser to keep up with them.

In high-velocity markets, appraisal values lag market prices when markets move faster than usual. The appraisal process compares recent past sales, so even very recent backward-looking data won’t keep pace with present prices.

For example, some homes hit the market and sell instantly in hot areas with low inventory. These homes typically have multiple offers.

This has been the case across the country over the last several years. Supply and demand play a significant role in determining home values.

In regions with bidding wars, it is not uncommon to see prices tens of thousands or more over the asking price. This can cause an appraiser a significant dilemma.

The appraiser looks at recent comps to price the home, but the latest sales may not be readily available to compare. You can request that the appraiser consider homes under contract that haven’t closed yet, but they are not required to grant your request.

Real Estate agents have the same dilemma when pricing a home for sale. Sometimes, agents and appraisers have to use their better judgment on value.

6. Some Appraisers Are Overly Cautious

An appraisal under the contract price will happen more frequently when there is a conservative appraiser.

Many appraisers will not go out on a limb like they used to. The lasting impact of the 2008 housing crash and subsequent regulatory changes has significantly impacted the appraisal industry.

Before the housing crisis, appraisers maintained strong connections with other real estate professionals. However, direct relationships between appraisers, real estate agents, and lenders have diminished in today’s environment.

As a result, appraisers have become more prudent in their property valuation practices.

7. The Buyer Had No Guidance on What to Offer.

Every day, thousands of properties have price reductions. This means one thing—the home was not priced appropriately.

Every day, thousands of properties have price reductions. This means one thing—the home was not priced appropriately.

The seller was overzealous, or the agent promised the moon, giving an unrealistic value.

On occasion, in states where dual agency exists, a buyer will go directly to the listing agent. Without a buyer’s agent to guide them, they end up significantly overpaying for the property.

When purchasing a home, having a buyer’s agent representing your best interests always makes sense. Don’t be conned by dual agency.

Unfortunately, dual agency happens more frequently in hot seller’s markets where buyers think they can gain the upper hand by going directly to the listing agent.

8. The Home is The Best One in The Area.

For example, getting the right price for home improvements and additions can be difficult when the home you want is the best in the area.

No matter how perfect the house is, the fact that it is a step above all the others will not be as important as you would like.

The appraisal value will be dragged down somewhat by the other homes in the area. This is called the appraisal regression theory. This can be hard to explain to a seller as a real estate agent.

For example, in Milford, Massachusetts, one of the towns I cover, there are very few high-end sales. When someone is selling a luxury home in this town, it can be challenging because so few buyers are willing to commit. Today, many buyers consider a house an investment and a place to call home.

They don’t want to commit to spending at the top of the market because they know they may have difficulty getting their money back years later. The lack of upper-end home sales is a problem for selling and appraising.

9. There is Functional Obsolescence.

Not many people know functional obsolescence except appraisers and some very educated real estate agents. Functional obsolescence is when features that are not practical or desirable affect market value. Here are a few examples:

- A decent size home that only has one bedroom.

- Having to get into your master bedroom by walking through a dining room.

- Walking through one bedroom to get to another.

- Having to enter from the garage into a formal living space.

These characteristics are not ideal. It is undoubtedly feasible for an appraiser to arrive at a lower-than-expected value because of these issues.

10. There Are Not Enough Homes in The Area to Compare To.

When there are few homes nearby to compare to, the appraiser has no choice but to look further to find similar homes to aid in the appraisal. Unfortunately, where the appraiser seems may not be where you would like them to be.

For example, sometimes there aren’t enough comps in one town, so the appraiser has to go outside the city or town.

Not long ago, I had to evaluate a high-end antique in Ashland, Massachusetts. There had been no comparable real estate sales in the town in the last six months or even a year, so I had to look outside to find comparable sales.

I used some sales in nearby towns that had the most similar real estate value scale as Ashland.

Whenever you have to go outside the community, it is far more difficult for an appraiser. It significantly increases the odds of an appraisal coming in low.

The appraiser’s comps may be in an area that is not as pleasant or desirable as your home’s location, which can negatively impact the appraisal value.

You may need to point out the problem to the appraiser because good comps need to be as similar to your home as possible – including the quality of the location.

10. The Home You Are Looking at Has a Great View.

A great view is worth something. The comps the appraiser is using may not have as nice a view as your home, which could lead to a lower appraisal value.

A great view is worth something. The comps the appraiser is using may not have as nice a view as your home, which could lead to a lower appraisal value.

You can let the appraiser know about the view. Of course, there is also the possibility that the value you place on the view is not the same value the appraiser does.

When selling a waterfront property, evaluating views and even just the setting is expected. These homes are more scarce and have fewer comps to create an accurate value.

Many factors go into appraising a property. A view is more subjective than many.

11. The Appraiser Lacks Skill and Experience.

Some people are not very good at their jobs. Others are new at their jobs and do not have the experience necessary to do the task as well as they could.

This is common with all businesses and is no different in the appraisal industry. As much as appraisers think they are infallible, that is not true.

You may find yourself in a situation where the appraiser you are working with falls into one category or the other.

The appraiser may be in the wrong profession or have appraised very few homes. You can research to determine if there is a problem with the appraiser and request a different one if necessary.

Keep in mind, though, that a low appraisal is usually not due to a lousy appraiser. Only request a different appraiser if you feel sure that the assessment is grossly incorrect.

12. You Are Overpaying.

Buying a home is an emotional experience. Buyers can get caught up in finding their dream home and offer more than they should—and more than the house is worth.

As a home seller, you may have to face the buyer overpaying based on accurate, comparable sales data. This becomes more common when homeowners price their properties based on an unrealistic online home value estimate.

You might have to bite the bullet and accept this fact when it happens.

There will be a few choices, including having to drop your price. If you are lucky, the buyer may decide to participate and put more money down to satisfy the lender.

Final Word

Nobody involved in a real estate transaction wants to get the dreaded call saying that the appraisal has come in low. When this happens, everyone’s stress level skyrockets. The time it takes for an assessment to be completed can be nerve-racking for all parties.

In situations like these, cooler heads prevail. Get together with your real estate agent and create a plan to deal with the problem.

About the Author: Bill Gassett, a nationally recognized leader in his field, provided information on how often an appraisal comes in low and why. He is an expert in mortgages, financing, moving, home improvement, and general real estate.

Learn more about Bill Gassett and the publications in which he has been featured. Bill can be reached via email at billgassett@remaxexec.com or by phone at 508-625-0191. Bill has helped people move in and out of Metrowest towns for the last 38+ years.

Are you thinking of selling your home? I am passionate about real estate and love sharing my marketing expertise!

I service Real Estate Sales in the following Metrowest MA towns: Ashland, Bellingham, Douglas, Framingham, Franklin, Grafton, Holliston, Hopkinton, Hopedale, Medway, Mendon, Milford, Millbury, Millville, Natick, Northborough, Northbridge, Shrewsbury, Southborough, Sutton, Wayland, Westborough, Whitinsville, Worcester, Upton, and Uxbridge MA.