Homeowner Associations (HOAs) shape the essence of community living. Managing both appeal and order within neighborhoods, they evoke mixed feelings among residents and potential buyers. I will help you understand the intricate balance between the benefits and drawbacks of HOA fees.

Homeowner Associations (HOAs) shape the essence of community living. Managing both appeal and order within neighborhoods, they evoke mixed feelings among residents and potential buyers. I will help you understand the intricate balance between the benefits and drawbacks of HOA fees.

- Understand maintenance benefits and amenity access.

- Explore potential fee increases and special assessments.

- Assess impacts on property values and homeowner autonomy.

From owning several condos in multiple states and selling real estate for the past three decades I have a firm understanding of HOA fee pros and cons. It is essential for potential buyers to know they value they are getting from these expenses. In some circumstances the costs can make perfect sense. On the other hand, you could pay for things you don’t need. Understanding the financial strength of the homeowners association is always a vital consideration.

You can expect to pay an HOA fee in most circumstances when you buy a condo or townhouse.

Let’s dive deeper into what HOA fees mean for homeowners.

What is a Homeowners Association(HOA)?

A homeowners association (HOA) is a governing body in a residential community that enforces rules and maintains common areas. It typically manages the collective interests of homeowners within subdivisions, planned neighborhoods, or condominium complexes.

The HOA sets and enforces community standards, manages budgets for upkeep shared spaces, and often provides amenities like pools, fitness centers, and landscaping. These organizations collect fees from residents to fund these activities. They ensure the community maintains a certain aesthetic standard and functionality, enhancing all owner’s housing values and quality of life.

A condominium association runs a condo community.

What Are HOA Fees?

Homeowner Associations (HOAs) collect fees to manage and maintain residential communities. These expenses are crucial for the operational costs of shared spaces and services. They ensure that common areas are well-kept, amenities are operational, and the community adheres to a standard that protects property values.

Understanding HOA Dues

HOA fees are typically mandatory for residents in managed communities. These fees vary significantly depending on the community’s size, location, and amenities. They often cover:

- Landscaping and Common Area Maintenance: Regular upkeep of shared spaces like parks, medians, and entryways.

- Building Maintenance: For communities with shared structures, fees cover the costs of repairs and upkeep.

- Utility Costs for Common Areas: Lighting for street lamps and electricity for community centers or gyms.

- Insurance: Often, part of the fees goes towards insurance for damage to common areas.

Residents might pay anywhere from $100 to over $1,000 monthly, with an average cost of around $200 to $400 in many suburban areas. When I moved from a house to a condo a few years ago, paying someone else to take care of everything for me was a substantial perk. I like to travel and spend my weekends not thinking about housing chores.

Making a condo purchase was one of my best decisions. I wish I had downsized sooner.

Real-World Example of Fee Allocation

The monthly HOA fee is approximately $250-350 in a typical condo community. This fee covers:

- Landscaping of common areas and front lawns

- Upkeep of community facilities like the swimming pool, tennis court, and clubhouse

- Security services, including gated entry and 24-hour patrol

- Basic cable and internet services as part of a community-wide contract

This example demonstrates how fees, while often seen as an extra expense, provide essential services that maintain the quality and security of the living environment. Before committing to a purchase, I recommend you ask many questions about HOA fees. Having a handle on costs is essential to feel confident you’re getting your money’s worth.

You can expect a higher HOA fee in communities with more amenities.

Now that we understand what HOA fees cover and their typical costs let’s examine the benefits they offer residents.

Benefits of HOA Fees

Paying HOA fees comes with several tangible benefits that enhance the living experience in a community. These advantages contribute not only to the upkeep of the property but also to the quality of life for the residents.

Paying HOA fees comes with several tangible benefits that enhance the living experience in a community. These advantages contribute not only to the upkeep of the property but also to the quality of life for the residents.

Maintenance and Upkeep

One of the most appreciated benefits of homeowners association fees is community maintenance. Residents enjoy beautifully manicured landscapes, clean shared spaces, and well-maintained roads without the need to manage these tasks themselves.

Example: The HOA hires a professional landscaping company that handles everything from lawn care to tree trimming. This ensures all homes have curb appeal and the neighborhood maintains a unified look.

This is one of the things I love about having a condo HOA. I no longer worry about scheduling and paying someone to plow my driveway. The HOA does it for me! I come home to everything looking beautiful.

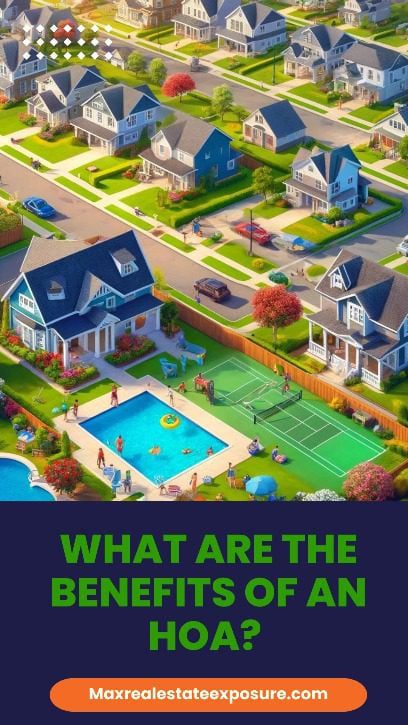

Access to Amenities

HOA fees grant residents access to amenities that might be unaffordable or impractical to maintain on their own. These include swimming pools, fitness centers, sports courts, and clubhouses.

Example: Residents of a luxury condo building in Miami benefit from a rooftop pool, a state-of-the-art gym, and a private cinema, all maintained through their HOA dues.

Enhanced Community Engagement and Safety

HOA fees often fund security measures and social activities that foster community and safety. This includes hiring security personnel, installing and maintaining surveillance equipment, and organizing community events.

Example: In a gated community, the HOA dues cover 24/7 security patrol services and CCTV surveillance, providing residents with peace of mind regarding their safety.

These benefits of HOA costs contribute significantly to the convenience and security of living in a managed community, enhancing its members’ overall quality of life.

Transitioning to Considerations

While the benefits are substantial, it’s also crucial to consider the potential downsides of HOA dues, which I will now cover.

Downsides of HOA Fees

While homeowners association costs offer notable advantages, they also have several downsides that can affect homeowners. Understanding these cons is crucial for anyone considering moving into an HOA-governed community.

Costs and Financial Burdens

HOA dues, along with mortgages, taxes, and insurance, are a significant financial obligation. They can be a heavy financial burden for some homeowners, especially those on fixed incomes.

Example: The monthly HOA fees are $400 in a retirement community. While the services are extensive, some residents find the fees financially challenging, mainly when unexpected increases or assessments occur. The problem with condo fees is that they can often change at a moment’s notice. In some places, they go up yearly.

Restrictions and Lack of Autonomy

HOAs often enforce a set of rules and regulations that homeowners must follow. These can include restrictions on painting, landscaping, renovations, and even minor details like the type of curtains visible from the street.

Example: A homeowner was fined for choosing an unapproved shade of blue for their deck, demonstrating how restrictive some HOA rules can be.

Potential for Fee Increases and Special Assessments

HOA fees are not static and can increase over time. Additionally, unforeseen expenses, such as emergency repairs to community amenities or legal fees, can lead to special assessments requiring extra homeowners’ payments.

Example: After a severe storm damaged shared roofs and fencing in a neighborhood, residents were required to pay a special assessment fee of $500 on top of their regular monthly dues to cover the repair costs.

I had this happen to me at the condo I own in Florida. The clubhouse needed a new roof, and the homeowners had to pay a special assessment to cover the cost. Selling a condominium with a special assessment can also be challenging. Potential buyers do not want to be saddled with unplanned expenses.

Buyers must ensure ample money in the reserve fund, which decreases the chances of out-of-pocket expenses. Not having proper funding is a financial red flag.

Real-Life Implications

HOA dues’ financial and regulatory aspects can lead to significant dissatisfaction among homeowners. They may feel they have little control over the community decisions that directly impact their living conditions and finances.

Impact on Property Values

The presence of an HOA can significantly impact property values, with the effect varying depending on the HOA’s expenses, rules, and amenities. Understanding these impacts can help homeowners and potential buyers make informed decisions.

Positive Impacts on Property Values

HOA-managed communities often benefit from enhanced curb appeal and uniformity, which attract potential buyers. The maintenance and amenities provided by the HOA can also increase property values.

Example: In a well-maintained suburban development where I live, townhomes command a premium price due to the pristine condition of public spaces, which are highly valued in the real estate market.

Negative Impacts on Property Values

However, high fees and restrictive rules can deter some buyers, potentially limiting the resale value of homes within these communities. Moreover, if the HOA faces financial troubles or legal issues, it can negatively affect all homeowners in the community.

Example: A community in Virginia saw a decline in property values after the HOA was sued for mismanagement of funds, which raised concerns about stability and resulted in higher fees to cover legal costs.

Balancing the Equation

Prospective and existing homeowners must weigh these factors carefully. The key is to assess whether the benefits, such as maintenance and amenities, outweigh the potential drawbacks of costs and restrictions.

Navigating Property Values

For those considering buying into an HOA community, I recommend you investigate the association’s financial health, fee history, and rule enforcement to avoid any negative surprises that could affect property values.

Navigating Homeowners Association Dues

Understanding and navigating HOA fees effectively is crucial for current homeowners and prospective buyers. Here are some strategies to help manage these fees and make informed decisions about HOAs.

Understanding and navigating HOA fees effectively is crucial for current homeowners and prospective buyers. Here are some strategies to help manage these fees and make informed decisions about HOAs.

Tips for Assessing HOA Expenses Before Buying

Before purchasing a property within an HOA, thoroughly review the association’s fee structure and financial statements. Here’s how you can approach this:

- Examine the HOA’s Budget and Financial Health: Look for signs of financial stability, such as well-maintained reserves and a clear, detailed budget. The attorney I refer to my clients always does this as part of their fee. It is an excellent protection for the buyer.

- Understand What the Fees Cover: Ensure the amenities and services justify the fees. Compare these dues with similar communities in the area.

- Check for History of Fee Increases and Special Assessments: Review the history of fee increases and any past special assessments to gauge potential future expenses.

Example: A buyer interested in a townhouse reviewed the HOA governing documents and discovered that the fees had increased by 5% annually over the past five years, prompting them to budget for future increases.

I always recommend that my clients make the purchase subject to a satisfactory review of these documents. This way, they can get their earnest money back if they don’t like something.

Strategies for Managing and Contesting Fee Increases

Once you are part of an HOA, there are ways to manage and even contest fee increases:

- Participate in HOA Meetings: I recommend you stay informed and involved in community decisions. Regular attendance at HOA meetings allows you to voice concerns and influence decisions. Most people don’t do this and can become disturbed when they get a financial surprise.

- Understand the Governing Documents: Familiarize yourself with the HOA’s rules and bylaws. This knowledge can empower you to challenge decisions or proposed increases that may not comply.

- Organize with Other Homeowners: If a proposed fee increase seems unjustified, collaborating with other homeowners can strengthen the opposition to such changes.

Example: Homeowners in a community successfully contested a proposed fee increase by collectively demonstrating that the increase was based on an overestimation of upcoming maintenance costs.

Advice from Professionals

Consulting with real estate professionals or legal advisors who understand HOA management can provide crucial insights and guidance, especially when considering significant decisions like challenging unenforceable HOA rules or adjusting to new fee structures.

Sometimes, dealing with an unruly association requires additional support.

Conclusion

Navigating HOA expenses is a significant aspect of living in a managed community. I recommend you always do plenty of research before making a buying decision.

Key Takeaways

- Upsides of HOA Dues: Maintenance, amenities, and enhanced community engagement substantially improve the quality of life and potentially increase property values.

- Downsides of HOA Dues: The financial burden, restrictions on personal autonomy, and potential for unexpected fee increases can pose significant challenges.

- Impact on Property Values: While well-maintained amenities can enhance property values, excessive fees and restrictive rules may detract from them.

Next Steps

Understanding how HOA fees work and what they cover is crucial for homeowners and potential buyers. If you’re considering purchasing a home in an HOA community or are currently living in one, engaging actively in HOA meetings and understanding your rights and obligations can make a substantial difference in your living experience.

The expenses are a significant part of the pros and cons of condos. Best of luck with your decision. If I can answer any questions, please contact me.

About the Author: Bill Gassett, a nationally recognized leader in his field, provided the above real estate information on the pros and cons of HOA fees. Bill has expertise in mortgages, financing, moving, home improvement, and general real estate.

Learn more about Bill Gassett and the publications in which he has been featured. Bill can be reached via email at billgassett@remaxexec.com or by phone at 508-625-0191. For the past 38+ years, Bill has helped people move in and out of Metrowest towns.

Are you thinking of selling your home? I am passionate about real estate and love sharing my marketing expertise!

I service Real Estate Sales in the following Metrowest MA towns: Ashland, Bellingham, Douglas, Framingham, Franklin, Grafton, Holliston, Hopkinton, Hopedale, Medway, Mendon, Milford, Millbury, Millville, Natick, Northborough, Northbridge, Shrewsbury, Southborough, Sutton, Wayland, Westborough, Whitinsville, Worcester, Upton, and Uxbridge Massachusetts.