Preparation For Getting a Home Loan

Are you looking at how to get a mortgage? If so, thinking about owning your first place is probably exciting. Buying a house is a big deal.

Every buyer should think about how to prepare to get a mortgage before making a home purchase!

Every buyer should think about how to prepare to get a mortgage before making a home purchase!

One of the things that first-time home buyers will often ask me is what they should do first in the home-buying process.

My answer is always the same: to go out and get pre-approved for a mortgage. A pre-approval is a crucial step in the mortgage application process. Preparing to get a mortgage, however, is something that many buyers don’t often think about.

Taking out a mortgage loan is one of the most essential parts of the home-buying process.

The amount that a person is approved for will often dictate how much they have to spend on the house. The interest rate will determine how much a borrower will pay for the next fifteen to thirty years if the mortgage is kept that long.

Considering these reasons, preparing for the upcoming mortgage loan is a good idea before walking into the bank and asking for approval. From many years of experience as a Realtor, many homebuyers don’t know the factors that influence a lender’s decisions.

Before examining the steps to getting a mortgage, look at some basic facts below every potential buyer should know before becoming a homeowner. Understanding these basic concepts will make the road to homeownership more straightforward.

Facts to Know About Home Loans

1. A mortgage is a loan used to finance a property purchase.

2. You typically need a decent credit score to get a mortgage.

3. Lenders will consider your income and employment history when determining if you qualify for a mortgage.

4. The size of the down payment you can make will affect the type of mortgage you can obtain.

5. different types of mortgages are available, such as fixed-rate and adjustable-rate mortgages.

6. Mortgage interest rates can vary based on market conditions and your financial profile.

7. It’s important to compare mortgage offers from different lenders to find the best deal for your situation.

8. Applying for a mortgage usually involves providing financial documents, such as tax returns and bank statements.

9. Getting a mortgage often includes an appraisal of the property to determine its value.

10. Once approved, you will sign a mortgage agreement outlining the terms and conditions of the loan.

Here are some steps to help ensure the financial house is in order before taking out a mortgage loan. Following these steps will make getting a mortgage much more accessible.

Understand What Mortgage Lenders Want From Borrowers

One of the keys to getting a home loan is to know what a lender will be looking for from consumers. There are several guidelines and factors at play you need to know. These situations will dictate how easy it will be to procure financing.

Your Job History and Present Income

When applying for a mortgage loan, your income is a crucial factor that lenders consider. While there is no specific income requirement to buy a house, your lender must ensure that you have a consistent cash flow to repay the loan.

To verify your income, your lender will assess your employment history, monthly household income, and any additional sources of income, such as child support or alimony payments. They will examine your business’s w-2s and tax return documents for proof.

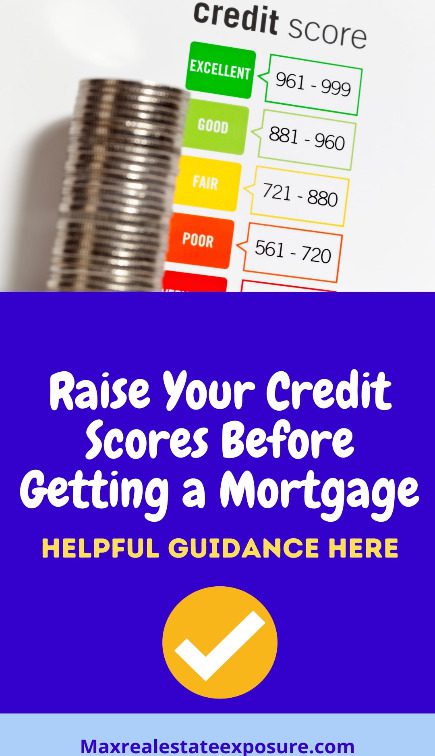

Credit Scores Play a Significant Role in Loan Rates and Terms

Your credit score plays a huge role in determining whether you can secure a mortgage. A higher credit score indicates to lenders that you are diligent in making timely payments and have a responsible borrowing history. Conversely, a lower credit score suggests to lenders that you may have a track record of mishandling your finances, making you a riskier borrower.

A minimum credit score of 620 is typically required for a conventional loan. However, you will need a credit score of at least 580 for a government-backed loan, although this requirement may vary depending on the specific loan program. An FHA loan is an excellent option, as the requirements are more lenient. Checking out these loans is often one of the recommendations I make to my clients.

Having a higher credit score can provide you with more options when it comes to lenders and can also result in lower interest rates. If your credit score is on the lower side, it is advisable to improve it before applying for a loan, such as by implementing strategies to boost your credit score over a few months.

What Are Your Current Assets

When purchasing a home, lenders must have assurance that you have a financial safety net in case of unexpected events. This gives them confidence that you can continue making your mortgage payments even if you face financial difficulties.

To assess your financial stability, lenders will request to review your assets, encompassing any account from which you can withdraw cash. Some examples of assets include money market accounts, savings accounts, CDs, retirement accounts, and taxable investments.

They will look at bank statements and other investment accounts to verify this information.

What is Your Debt-To-Income-Ratio?

Like your income and credit score, your debt-to-income ratio is a critical factor that lenders consider when determining your eligibility for a mortgage. Your DTI is calculated by dividing the total of all your minimum monthly debt payments by your gross monthly income.

Lending institutions will include recurring debts like credit card payments, student loans, and auto loans in this calculation. Lenders care about your debts as much as your income, if not more. Your bills and expenses are significant parts of obtaining a mortgage.

The specific DTI requirement will vary depending on the type of mortgage you’re applying for. Conventional mortgages typically have a benchmark DTI of 50% or lower, while government-backed loans may have a higher threshold.

Now that you know what a lender wants, let’s examine some recommendations for achieving your homeownership goal.

Check The Credit Report and Correct Mistakes

Ensuring your financial cards are in order is a significant part of getting a mortgage! The Federal Trade Commission estimates that as many as one in five people have a substantial error on their credit reports.

Next, add in the idea that just ten points higher or lower on a credit score could potentially mean a difference of tens of thousands of dollars in interest paid over the lifetime of a mortgage.

It should be obvious why checking a credit report before stepping into a bank is critical. Similarly, ensure no recent delinquencies or collection notices on the account. If such problems were recently resolved, wait several months before applying for a mortgage.

This step should be completed several months before a person can apply for a mortgage. If errors are discovered, it can be a long and frustrating process to begin correcting them.

You can get a free credit report from the three major credit bureaus, so you should take advantage of this.

Raising Your Credit Scores Helps

Considering the potential savings that can be made by raising a score by just a few points, it is worth ensuring that the credit report is accurate.

Considering the potential savings that can be made by raising a score by just a few points, it is worth ensuring that the credit report is accurate.

Making sure your credit history is accurate should be an essential part of preparing for getting a mortgage.

Working on having a good credit score can also save you a substantial amount of money over the life of the loan.

Mortgage lenders reward those borrowers with the best credit scores through the best financing terms.

If you are unsure of the best ways to raise your credit score, sign up for Credit Karma. Credit Karma is a credit decision service that offers free advice.

Following their credit advice can quickly bump up your credit scoring.

Establish Income and Assets

Before a bank or other lending agent approves an individual for a loan, they want to be sure that the person can repay the loan in full. For their reassurance, the lending officer will typically examine two main areas.

The first will be the monthly income of the potential borrower. Those interested in taking out a loan should avoid job-hopping in the months leading up to the loan application process.

Holding down a job for several months, preferably several years, before applying will give the lending institution a good idea of how much money a person has that can potentially go towards repaying the loan.

The mortgage process will always be smoother as lenders love stability. Real Estate agents see this firsthand when some borrowers relocate and have a job change.

You’ll Need a Paper Trail to Help Document Your Financing Ability

Similarly, the lending institution will want to see that the borrower has assets to help back up the loan. They will investigate any paper trails so it does not work to transfer money into a savings account from a relative in the days or weeks leading up to the application.

The assets in the bank should be established. Getting your financial house in order is critical to preparing for a mortgage.

Understanding how to get a mortgage today is much different than in years past. It would be best if you were prepared to have everything you have done financially recently scrutinized to the nth degree.

Many will tell you that getting a mortgage today is like being hired by the federal government to work in the White-house.

In other words, the lending institution will leave no stone unturned in ensuring you are a valid candidate for a mortgage.

Know What You Can Afford

When preparing to purchase a home, it is essential to understand what you can afford. Many folks would love to live in a luxury mansion, but stretching beyond your means is often a significant mistake.

When mortgage interest rates are rising like now, you must adjust your budget to something manageable.

What mortgage lenders will be looking at is your debt-to-income ratio.

As mentioned, debt-to-income (DTI) is a metric used to ascertain an individual’s level of financial health, calculated by taking the total of all of their monthly debt payments and dividing it by their gross monthly income.

Fannie Mae and Freddie Mac loans accept a maximum debt-to-income (DTI) ratio of 45 percent. For those with higher DTI ratios, reducing debt before purchasing a home is advisable. Many financial advisors suggest keeping your DTI ratio closer to 36 percent.

Even though a lender may say you can afford more, it often wise not to become a slave to your home financially. You'll want to have money to do other things with your life.Click To TweetWe will talk a bit more about debt to income shortly.

Save For a Down Payment

An ample down payment is one of the more critical aspects of getting a mortgage. The amount of money you can save will impact the type of mortgage you’ll be able to get.

While many first-time buyer programs exist, some have specific down payment requirements.

One of your goals, if possible, should be striving to reach a 20 percent down payment. With a 20 percent down goal, you will avoid paying private mortgage insurance (PMI), which can save significant money.

You’re also likely to get better mortgage terms when you have more money. The lender will see you as a lower risk when the property has more equity.

The average down payment for first-time buyers is 6 percent. Non-first-timers average around 12 percent.

Build Financial Reserves on Top of Your Down Payment

On top of your down payment, having money in reserve for emergencies is also advisable.

It is advised that homeowners have an equivalent of roughly six months’ worth of mortgage payments stored in a savings account even after making the down payment.

A financial cushion can protect in the event of job loss or unforeseen circumstances.

Budget For Closing Costs

Another significant expense you’ll want to set aside is closing costs. A home buyer’s closing costs can be considerable.

The mortgage lender will be required to break down the closing costs you’ll pay. Some borrowers choose a no-closing cost loan if they don’t expect to be in a home for a long time. Doing so can save you money.

Eliminate Other Debt When Getting Financing

Often, the other facet that home buyers don’t think about enough when getting a mortgage is their current debt load.

Often, the other facet that home buyers don’t think about enough when getting a mortgage is their current debt load.

Buyers often overlook where they currently stand with other financial obligations in the excitement of wanting to have their first home.

Banks often want to avoid having the debt of a particular person surpass a certain percentage of their monthly income. This means they will closely scrutinize any other debt, such as credit card debt, car loans, etc.

If possible, pay off all credit cards and as many other types of debt as possible to minimize the monthly debt payments.

Don’t Get Other Loans

Similarly, taking out a new mortgage is not the time to try to get a new loan for something else.

Even if the person will still have a meager income-to-debt ratio, recent credit applications are a red flag for loan agents.

The new credit can put a severe dent in a credit score, at least temporarily, which could result in a higher interest rate or even rejection when applying for a mortgage.

It is best to wait until the mortgage is secured and the papers are signed before looking at other lines of credit.

Being in the real estate industry for the past thirty-six years, I’ve heard horror stories from the mortgage broker I work with.

One of the common errors that home buyers make is going out and getting a new car or buying furniture while getting a mortgage to purchase a home.

There are times when this has caused a buyer to be unable to close on a property! Financing a large purchase while trying to secure a home mortgage is a huge mistake.

It could cause you not to be able to close on your property when you are scheduled to! Part of preparing to get a mortgage is being fiscally responsible during the process.

Find A Mortgage Lender You’ll Love

Choosing a lender that satisfies your needs is one of the most critical steps in getting a mortgage loan. Your buyer’s agent should be an excellent resource to provide references.

Shopping for a mortgage lender by comparing apples to apples will be essential. Do they have the right mortgage program that fits your goals?

For example, if you are purchasing a house that needs work, you might want to use a 203k mortgage. Some lenders may offer this type of loan, while others may not. You can also find better terms from one lender to the next.

Mortgage shopping is one of the more intelligent things you can do when buying a house.

Navigating the various mortgage loan options available to you can be a daunting task. To ensure you receive the most favorable terms, consider enlisting the help of a mortgage broker.

Brokers are experienced in helping individuals secure loans with the best interest rates, fees, and terms available. It is important to note that mortgage terms may vary substantially between lenders.

Make sure you get your mortgage questions answered before making a final choice. There are so many loan products today, so research is necessary.

Choose The Right Mortgage Terms and Type

There are many considerations to think about when it comes to mortgage terms. Do you want a fixed or adjustable-rate mortgage? How about the mortgage length?

The two most popular mortgage time frames are a 30-years and 15 years. However, other options include 10, 20, and 40-year mortgages.

There are three common types of mortgages to choose from. They include conventional mortgages, government loans, and jumbo mortgage loans.

Conventional loans are excellent for buyers with good credit and a solid down payment.

All lenders, including banks, credit unions, mortgage companies, and private lending institutions, offer conventional loans.

Popular government loans include FHA, VA, and USDA mortgages. These are excellent no or low-down payment options.

Jumbo Loans work well for borrowers who are purchasing expensive homes.

Get Pre-approved and Lock In The Rate

Once the process of filling out applications for mortgage loans has begun, there are two critical steps. First, make sure you get pre-approved for a loan.

Once the process of filling out applications for mortgage loans has begun, there are two critical steps. First, make sure you get pre-approved for a loan.

Understand a distinct difference between being “pre-qualified” for a loan and getting pre-approved.

In most circumstances, having a pre-qualification letter means nothing more than you have the income to afford a specific price point when looking at homes.

Getting pre-approved, however, is a lot more involved. The lender will check your credit, verify your financial status, and check your employment.

After all these things are done, the mortgage company or bank will have a pretty good picture of who you are as a borrower.

When buying or selling a home, one of the most frustrating developments for everyone involved is the offer falling through.

For this reason, sellers are often most interested in buyers pre-approved by their bank for a loan.

This means that they have a definite idea of how much they are approved for, and there will not be any problems with securing the necessary loan.

Locking Your Mortgage Rate is Key

Secondly, once the borrower has secured a home mortgage that they are happy with, it is essential to lock in the rate. Since mortgage rates change daily, borrowers should not assume that the mortgage they qualify for today will be available tomorrow unless they lock in the rate.

It is also important not to assume that any particular rate is locked in unless they have written reassurance.

This becomes especially important if your finances are tight, and the rate increase could cause you to no longer qualify for the loan.

I have witnessed mistakes made by mortgage brokers who do not listen to their clients and fail to lock in a mortgage rate. Be sure to document any discussions with your mortgage broker or lender when locking a rate!

Securing a mortgage is one of the most critical aspects of the entire home-buying experience. The mortgage terms determine how much a buyer can spend on a home and how much they will pay each month for the next fifteen to thirty years.

The appropriate steps to secure the best mortgage can make the real estate process more manageable.

Completing The Closing Process

The last step in getting a mortgage is completing the closing process and attending the closing with your real estate attorney and Realtor.

From start to finish, you can expect the time to close on a house to be around 6-8 weeks. Following the steps outlined here, you should be confident to reap the benefits of homeownership.

Noteworthy Lending Statistics a Potential Homebuyer Should Know

1. Approximately 63% of first-time homebuyers in the United States secure their mortgages through conventional loan programs.

2. Over 72% of mortgage applications are approved by lending institutions annually.

3. The average down payment made by homebuyers is approximately 15.7% of the total property value.

4. Mortgage applicants with credit scores above 740 are 36% more likely to receive a lower interest rate than those below 660.

5. An estimated 18% of mortgage applicants opt for adjustable-rate mortgages (ARMs) rather than fixed-rate mortgages due to their initial lower interest rates.

6. Homeowners who pay an additional $100 toward their principal each month can save an average of $24,000 over a 30-year mortgage term.

7. Mortgage loan officers spend an average of 34 minutes reviewing each applicant’s financial documents during approval.

8. Approximately 82% of self-employed individuals face more rigorous requirements and documentation when applying for a mortgage than traditionally employed borrowers.

9. Mortgage pre-approval increases the chances of securing a loan by around 42%, providing potential buyers a competitive advantage in the housing market.

Final Thoughts

Following this advice when getting a mortgage will put you in a great financial position, knowing that you did all you could to have the best mortgage terms and conditions moving forward.

Doing all your homework and preparing for a mortgage in advance will put you in a great spot to start your journey of finding the home of your dreams.

Hopefully, you have found this advice helpful in preparing for financing.

Other Mortgage Resources Worth Reading:

- What you need to know about procuring a mortgage via Bankrate.com

- Ten tips for preparing to get a home mortgage by Transunion.com

Use these additional resources to help prepare to get a home mortgage that will fit your needs and budget.

About the Author: Bill Gassett, a nationally recognized leader in his field, provided the above real estate information on the steps for getting a mortgage. He is an expert in mortgages, financing, moving, home improvement, and general real estate.

Learn more about Bill Gassett and the publications he has been featured in. Bill can be reached via email at billgassett@remaxexec.com or by phone at 508-625-0191. Bill has helped people move in and out of Metrowest towns for the last 38+ years.

Are you thinking of selling your home? I am passionate about real estate and love sharing my marketing expertise!

I service Real Estate Sales in the following Metrowest MA towns: Ashland, Bellingham, Douglas, Framingham, Franklin, Grafton, Holliston, Hopkinton, Hopedale, Medway, Mendon, Milford, Millbury, Millville, Natick, Northborough, Northbridge, Shrewsbury, Southborough, Sutton, Wayland, Westborough, Whitinsville, Worcester, Upton, and Uxbridge MA.

Bill, Funny as I read your article – I’m not sure the rules have changed all that much over the last 30 years. I just think they’re more visible with the Internet & experts like you sharing information … and homeowners scouring the web to get much smarter about things.

I can recall when we bought one house, I had to deal with an unpaid Macy’s bill per the bank. It makes me mad that the consumer is always the one that gets penalized. I had moved and between Macy’s & post office, I never got a bill … so how could I pay it? Needless to say, I refuse to use all the silly little credit cards now & stick with one personal card.

Tina – you are right about mistakes that happen that causes issues with peoples credit reports. What drives me nuts is all the hoops they put you through in order to correct the errors. Given how easy it is to have an error it makes preparing to get a mortgage a critical exercise!

What you said about getting your financial house in order being a key part in preparing to get a mortgage really stood out to me. I can’t think of a better way of improving your chances of getting a loan than showing financial responsibility.

I appreciate your great tips for getting a good mortgage. My wife and I are hoping to buy a home soon, so this is perfect for us. I’ll have to be sure and check our credit reports before we do anything else!