How To Compete With A Cash Real Estate Offer

Do you want to know how to beat a cash offer on the house?

Do you want to know how to beat a cash offer on the house?

Whenever real estate markets turn to favor sellers, the odds of being up against multiple offers for a home increase. The chance of a bidding war increases exponentially in a hot market.

Quite often, some bidders come to the table with no mortgage contingency. Many of these buyers are offering to pay cash for the home.

In any competitive housing market, cash buyers are viewed with apprehension by other people looking to purchase homes.

Credit buyers often feel they cannot compete with cash buyers, which can be upsetting when a cash buyer places a bid on a person’s dream home.

Cash does offer benefits for sellers and can be tough to compete with.

When a seller receives a cash offer, they do not have to worry about banks or loans, and the entire process tends to run smoother and quicker.

However, that does not mean competing with a cash offer is impossible.

So how do you win the house you want when there are cash offers? The trick is always to make the credit offer look more appealing to the seller.

Here are some tips for competing with a cash offer to secure the perfect house. Use these tips wisely to construct an offer with a fighting chance of beating the cash proposal. These tactics can increase your chances of winning when bidding against a cash buyer.

Make Sure The Seller Knows The Offer is Secure

Having a home sale fall through is incredibly frustrating for any seller, and financial difficulties are a common problem. A deal falling through is one reason why cash buyers are so appealing.

The cash is available upfront without wondering if the purchaser will get financing.

To make an offer more tempting, the credit buyer should come to the table with plenty of evidence that their bid is just as reliable. When a buyer asks how I can compete with a cash offer, this is how to do it!

A pre-approval letter from a lender indicating that the buyer is well-qualified and approved can help justify some of the seller’s concerns. Ensure you understand the distinction between pre-approval and pre-qualification letters, as they differ.

If Possible, Make The Pre-approval Letter Well Above The Purchase Price

A pre-qualification letter is virtually worthless and not what a seller or a savvy real estate agent wants to see.

A pre-qualification letter is virtually worthless and not what a seller or a savvy real estate agent wants to see.

Another tactic to make your offer look stronger is to have the pre-approval letter show a much higher approval amount than what you have offered the seller.

Those comfortable being open with the seller should also consider making financial information available to the seller, such as employment information or assets, to help bolster the claim that a loan for the particular person is a sure thing.

For example, if you have a bank account that is flush with cash but chooses to get a mortgage for your financial reasons, at least the seller knows you have the money available as a fallback plan.

Some buyers get home loans out of convenience and not necessity. Having a mortgage payment can be beneficial to use as a tax deduction. It’s one of the tax benefits of owning a house.

Send a proof of funds letter showing you have enough cash to close, whether using a mortgage or not.

Be Prepared to Bid Higher Than The Asking Price

Cash buyers know that their offers look appealing to sellers because of their ability to pay cash upfront.

For this reason, they sometimes expect some discount on the asking price. The credit buyer can help counteract the appeal of the cash bids by providing a competitive offer.

Since the credit customer knows they may have to offer a little more significant than the cash buyer, it is probably a good idea to consider homes lower in the personal price range.

Doing so will give a buyer more room to make that higher offer to win the house without going over budget.

Nothing will make a seller think twice about accepting your bid than offering more money. No seller wants to leave money on the table.

Use an Escalation Clause in Your Offer to Beat Cash Bidders

An escalation clause is one of the best tools in a competitive market. It’s possible to become the best offer by properly using an escalation clause!

Some of the better real estate agents will suggest putting it in the real estate contract to their clients. The key is using the escalator properly, which many agents don’t.

The amount you’re willing to go over the highest offer must be substantial. Many agents will make the “escalator” $1000, which is pointless.

What seller is going to forgo a cash buyer because of $1000? Try none! The bottom line is you need to make a seller think twice about not going with cash sales.

Many sellers would think twice about getting ten thousand dollars more in their pocket. The key is keeping other real estate contingencies to a minimum.

Make Every Effort to Speed Up The Process

One of the most appealing aspects of cash buyers is having a fast closing. The closing process can be time-consuming when financial institutions are involved.

One of the most appealing aspects of cash buyers is having a fast closing. The closing process can be time-consuming when financial institutions are involved.

Specific steps, such as waiting for appraisals and loan approval, can add weeks or months to the process.

The average time to close with a mortgage is 45 to 60 days. Speak with the loan officer to try and learn what can be done to speed up the timeline.

For example, ask the mortgage broker to schedule a real estate appraisal appointment immediately.

Some of the most considerable delays with financing occur because of the time it takes for the appraisal.

When an offer is made on the home, the credit buyer can let the seller know they have already contacted the lender and ask them to order the appraisal right out of the gate.

Some parts of the country also allow for loans to be secured in as few as fourteen days, so if this is an option, also pass on to the seller how quickly the loan paperwork can be finalized.

Have your mortgage broker write a letter stating how quickly they turn around their loans.

Schedule a Home Inspection Immediately or Skip it Altogether

Similarly, be in touch with a home inspector who can be brought out to see the house within a few days to complete the home inspections.

Finishing the inspection early can also let the seller know you’re a serious buyer intent on completing the purchase.

If the property you’re buying is a new home or you feel it’s in outstanding condition, waiving the inspection may make sense to make your offer more competitive.

In a hot housing market, it is not uncommon for home buyers to forgo a home inspection. It is a great way to make your offer more attractive to home sellers.

Waive The Inspection to Compete With Cash Offers

For example, some consider removing the home inspection clause if they are relatively sure there are no significant home inspection issues discovered. A lack of problems, of course, is more familiar with younger homes that have been well constructed.

If you are not that brave, another alternative is to make the home inspection escape clause have a higher dollar figure. In most real estate contracts with a home inspection contingency, a buyer can put in an amount of money by which they can cancel the contract if home inspection issues are discovered.

The last thing a seller wants to deal with is negotiating repair items after a home inspection. Letting a seller know upfront that you are not going to knit pick at every little problem the home inspector finds can go a long way in helping to make your offer more appealing.

Offer to Cover Any Appraisal Gap

Another significant benefit of cash buyers is not worrying about a low appraisal. It is common in offer situations where the sale price is bid up significantly to have appraisal problems.

It is certainly possible for the appraised value to come in under the sales price. The property appraisal is in the hands of the appraiser with no control over where they value the house.

Appraisal contingencies can kill many home sales in a seller’s market. The seller knows they will get their price regardless by offering to cover any appraisal gap between the agreed-upon sale price and appraisal amount.

Covering an appraisal gap is one of the best ways to make a strong offer that grabs the seller’s attention. By doing this, you’re giving the seller more confidence they will not make a mistake by choosing the highest bid.

In real estate circles, it’s known as an appraisal gap guarantee. Ask your real estate agent about adding this language to compete against cash offers.

Make a Portion of Your Earnest Money Non-Refundable

Yet another way of beating a cash offer on the house is to make some portion of your earnest money deposit non-refundable. You’ll have to decide how much you’re willing to risk.

If you feel one hundred percent confident nothing will prevent you from getting to the closing, then there is little risk. A seller will feel good knowing they can have some of the escrow funds.

Make Your Offer Personal

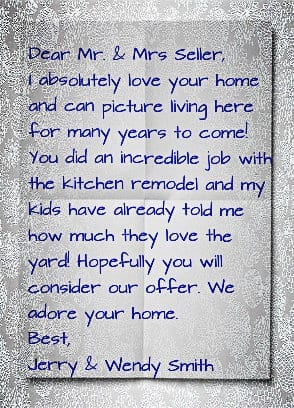

There are various ways to try and connect to the seller on a more personal level. Some people will send the seller letters describing their situation and their plans for the house.

There are various ways to try and connect to the seller on a more personal level. Some people will send the seller letters describing their situation and their plans for the house.

Other people will speak with their real estate agent and ask them to present the offer, not just email it over.

Sending a personalized letter may or may not have any impact if the seller makes rational decisions. Believe it or not, however, some will make decisions based on emotion.

If the offers are very close or even slightly better, the buyer who has connected personally with the seller could have the upper hand.

A few years ago, while selling a home in Northbridge, Massachusetts, I received multiple offers on a property. The seller chose to go with the non-cash offer because the seller was on the way out the door when the buyer arrived.

The seller was able to see the couple and their two small kids. The buyers ended up asking the seller and few questions about the home. There was a connection made with this particular seller.

The buyer was smart when making their offer by including a personalized letter mentioning all the great things about the property and how they knew their kids would enjoy growing up in the home.

This little personal gesture put their offer over the top.

Heartfelt Letters Can Be Considered Controversial

However, it should be noted that letters to the seller are now considered taboo. The listing agent might, in fact, not present it. Personal letters have become controversial due to the potential for a seller to be accused of discrimination.

That’s the reality of our society. Could a seller be sued for accepting one offer over another because of race? A family picture with a heartfelt letter might cause problems for a seller.

If you are going to send a letter, don’t add a picture or other information that has no bearing on the purchase. Keep the note strictly about the fact you love the property.

Remove Your Financing Contingency to Look Like a Cash Buyer

Some buyers will take risks by removing their mortgage contingency to make an offer seem even more appealing.

Some buyers will take risks by removing their mortgage contingency to make an offer seem even more appealing.

Doing so is one of the best methods for beating a cash offer on the house.

While you may not have the cash readily available, if you are 100 percent confident you can get the financing, some will take the risk of taking the financing contingency out of the offer contract.

While this risk often pays off, there are plenty of occasions when it does not.

Occasionally, it can be worth taking the chance for houses in a market where the buyer is very confident about the price and loves the place.

Still, people often jump too quickly when making these more significant gambles.

There are also other risks that buyers can take to help swing an offer in their favor. Removing common contingencies in real estate is a tangible way to beat cash offers that have them.

Give The Seller Their Desired Closing Date

One of the terms in a real estate offer that is almost always critical to a seller is the closing date.

When competing against a cash offer, being flexible with the seller’s desired closing is paramount. If the seller wants to close on a specific date, make sure you give it to them!

Having your buyer’s agent determine the seller’s needs before writing the offer is good business.

Offer to Let The Seller Rent Back The House

In real estate transactions, sometimes the seller may even need, for some reason, to rent the home back from you for some time.

The seller may require the equity out of their home but not have a place to live established yet.

Giving the seller a flexible term, like renting back for a period, could be a huge plus in your favor. Are you beginning to see how to beat a cash real estate offer?

Other Ways to Compete Against a Cash Offer

Another example is to increase what would be considered a standard escrow deposit. If putting 5% down with an offer contract is expected, make your deposit larger. The stronger you can make all the other terms in an offer, the greater the chance of being the winner.

You might also make your down payment more significant.

If, for some reason, the seller is offering some concessions, such as carpet or painting allowances, if the home needs them, you could waive the seller from having to do this.

You might get the seller’s attention by offering to pay a portion of their closing costs. Some home buyers have even provided more unusual things, like paying for a seller’s vacation.

Final Thoughts on Beating Cash Offers

Is a cash offer on a house better? Yes, there is no denying that competing against a cash offer will be difficult. The proposal’s convenience makes it very appealing, especially given the difficulties of dealing with a buyer procuring financing.

Do cash offers always win? No, of course not! The above advice will dramatically increase your chances of winning against a cash offer.

By doing so, you may beat the cash offer and end up with the home you have your heart set on!

About the author: Bill Gassett, a nationally recognized leader in his field, provided the above Real Estate information on how to beat a cash offer on a house. Bill can be reached via email at billgassett@remaxexec.com or by phone at 508-625-0191. Bill has helped people move in and out of Metrowest towns for 37+ years.

Are you thinking of selling your home? I am passionate about Real Estate and love sharing my marketing expertise!

I service Real Estate Sales in the following Metrowest MA towns: Ashland, Bellingham, Douglas, Framingham, Franklin, Grafton, Holliston, Hopkinton, Hopedale, Medway, Mendon, Milford, Millbury, Millville, Northborough, Northbridge, Shrewsbury, Southborough, Sutton, Wayland, Westborough, Whitinsville, Worcester, Upton, and Uxbridge MA.