Home Appraisal Myths You Need to Know

The home appraisal process can be nerve-wracking for many sellers. You probably already listed your home, and even received an offer, and now someone is coming in to tell you what the house is worth?

The home appraisal process can be nerve-wracking for many sellers. You probably already listed your home, and even received an offer, and now someone is coming in to tell you what the house is worth?

Someone who can quickly state a price that sinks your sale? It only makes sense to be concerned.

Fortunately, most house appraisals do not ruin a sale. However, there are some common myths that sellers believe that need to be dispelled. The more you know what to expect, the less likely you are to be unpleasantly surprised.

Keep reading to see appraisal myths far too many sellers believe.

1. The Appraiser Can Tell You What a Buyer Should Pay.

There is an art to pricing homes for sale, and the appraisal is only one piece of the puzzle. You can hire three different appraisers to price your home, and get three different prices – much like with real estate agents.

The appraiser will give an educated opinion on the value of the home based on training and experience. If the appraiser is good at what they do, then the price will usually be close to the market value of the home, but not always.

It can be pretty frustrating, then, to find out that the bank will not loan the buyer any more money than what the home appraises for. You, your Realtor and everyone else involved knows that the appraisal is only an opinion, but it is still the view the bank uses to base their loan decisions.

Appraisal gaps are more common when it is an extreme seller’s market and lots of bidding wars. Sales prices can often be bid up way over the asking price. In buyer’s markets it is much less common.

If the home is appraised lower than the offer, either you or the buyer will need to come up with the difference if you want to sell at that price. Sometimes there is a compromise. Both the buyer and the seller have a meeting of the minds. The seller comes down on their price a bit, and the buyer puts more money down to make up the difference.

These are your options unless you think there was a gross error that causes the appraised value to fall short of the contract price. In this case, you will need to know how to fight the appraised value. Winning an appraisal dispute is not easy. Make sure you or your real estate agent are well prepared.

2. A Home Inspection and an Appraisal Are The Same.

A home inspection and appraisal are very different. A home inspection is intended to identify issues with the home – issues that everyone should be aware of before money is exchanged. In contrast, an appraisal aims to determine the market value of the home. The real estate appraiser will look at similar homes in your area that have sold recently, also known as comps, to determine a value.

The home inspector is looking for mold infestations, problems with the foundation, roof issues, plumbing and electrical problems. The appraiser is comparing the features of your home to other similar homes to come up with a price for the lender.

There are times where the appraiser does take on the role of a home inspector. For example, if the borrower is getting an FHA or VA mortgage, the appraiser will look for certain deficiencies. Common problems these loan programs do not allow include the following:

- Peeling paint on the exterior of the home.

- Blatant safety hazards like railings missing from a deck.

- Missing handrails going down a set of stairs.

- No running water.

- Non-functioning heating system.

- Detached gutters.

- A fence is falling down.

You can see a complete list of problems that an appraiser may flag when doing an appraisal. Obviously, if you have any of these problems, it would be wise to fix them.

Always keep in mind a real estate appraisal and home inspection are NOT the same!Click To Tweet3. The More Money You Invest in The Home, The Higher it Will Appraise For.

One of the bigger myths in real estate sales is that every improvement adds value to a home. That is far from the case. In fact, there are some improvements that will bring down a home’s value! Many sellers are upset to discover that they do not get equal value for the improvements they made to the home.

One of the bigger myths in real estate sales is that every improvement adds value to a home. That is far from the case. In fact, there are some improvements that will bring down a home’s value! Many sellers are upset to discover that they do not get equal value for the improvements they made to the home.

You may have spent $75,000 remodeling the basement, yet the appraiser adds much less than what you paid to the value of the home. All that money and you are not going to get it back in the sale. Not only is finished space below grade evaluated differently, but the return is also not the same as above grade space.

The market value of your home is based on what people are willing to pay for it. Take a remodeled garage, for instance. You may have turned your garage into an excellent entertainment room. But the reality is that most buyers want a garage to park their cars in.

Most are satisfied to watch television in the main living room. What was important to you is not necessarily important to most buyers. It can be a sobering realization, but it has proven true time and time again.

Sellers should always be aware of the improvements that increase a home’s value so they make smarter investment choices.

Any good Realtor will tell you – if you are thinking about selling in the next few years, avoid making any upgrades without talking to an experienced agent. Do your research, because it may not be worth it in the long run.

4. The Appraiser is There to Serve The Needs of The Buyer.

You set your price, you got your offer, and now the buyer is paying for an appraiser to come in and determine the value of the home. It seems logical that since the buyer is paying for the appraisal, then the appraiser must be working for the buyer. But the truth is, the appraiser is there to serve the needs of the lender.

The lender requires an appraisal before it will lend money to a buyer. Lenders have a process that they do not deviate from – they are in business to make money, and they want to ensure that they can keep lending money. The lender has to make sure that they’re only lending as much money as the home is worth, and no more.

Fortunately, there are laws in place that prohibit any coercion of the appraiser. A good appraiser takes pride in being unbiased. While you may or may not agree with the appraisal, you can pretty much guarantee that the appraiser came to the price on his or her own.

People often wonder what the appraiser is looking at when they visit a home. From a homeowners perspective, this is important to know so you can increase your odds of not having an appraisal problem.

Buyers can protect themselves when making an offer by having an appraisal contingency. However, in a hot real estate market that favors sellers, many home buyers will waive their appraisal to make their offer more appealing.

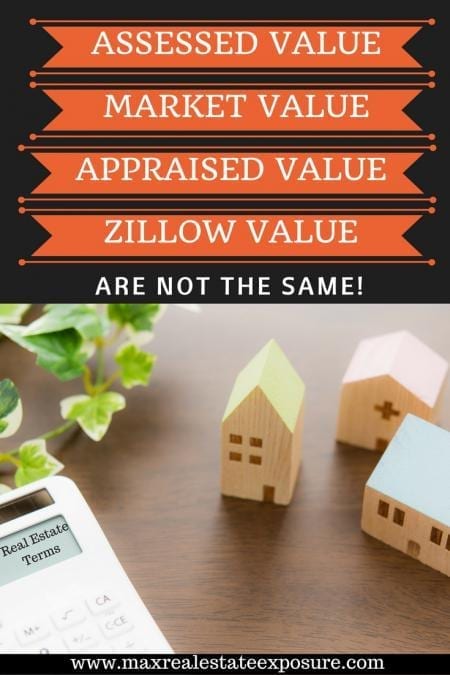

5. The Assessed Value, The market Value, and The Appraised Value Are The Same.

There are a lot of terms in real estate that get misconstrued. People interchange words all the time thinking they have the same meaning when they do not. Here are four different terms that have very different meanings:

There are a lot of terms in real estate that get misconstrued. People interchange words all the time thinking they have the same meaning when they do not. Here are four different terms that have very different meanings:

- Assessed value – An assessed value is quite simply what the local tax assessor believes your property is worth. While a large percentage of people think there is some sort or correlation to market value there isn’t! Assessed home values are just a yardstick for a city or town to collect an appropriate amount of taxes to sufficiently cover operational expenses.

- Appraised value – An appraised value is the opinion of a qualified appraiser. The appraised value is often sought either during the purchase and sale of a property or a refinance by an existing owner. Lenders use appraised value as a basis for giving borrowers a loan on a specific property.

- Fair market value – The fair market value of a home is the most competitive price a buyer is willing to pay and the lowest price a seller would be prepared to accept. Generally, the fair market value is the meeting of the minds of a buyer and seller. In theory, an appraised value and market value should be similar.

- Zillow value – A Zillow value is an online valuation. While there are many online valuation tools, Zillow is the most well known. A Zillow home value is the worst way to evaluate a properties market value. The Zillow estimate or “Zestimate” is often off by tens of thousands of dollars and sometimes much more. The estimate can be high or low. Zillow estimates are not reliable and should not be used as a basis for the property value.

6. A Better Home Guarantees a Better Price.

You can have the biggest and most beautiful home in the area, but that does not guarantee that the appraisal price will reflect how exceptional your home is. In fact, standing out too much can do more harm than good.

Homes are priced based on their area, most specifically their neighborhood. The appraiser will consider the size and amenities of other homes in your neighborhood to determine the price of your home.

If everyone else has 2,000 square feet of space and laminate counter-tops, but you have 4,000 square feet and granite counter-tops, you will probably get a price lower than what you were hoping for when the appraisal comes in.

The appraiser will price your home similarly to other homes in your area. Yours can be priced somewhat higher, but not enough to get your money back if you have turned your home into a palace.

Don’t Be The Big Dog in The Neighborhood

Unfortunately, being too exceptional can make your home seem less desirable to buyers looking in your area – high utilities, more to clean, more to keep up with.

If you’re surrounded by lower-priced homes, it will naturally bring down your home’s value. Skilled local real estate agents often will counsel not to over improve for the general area.

One of the most common examples of this is when someone buys their own lot. They proceed to build a custom property that doesn’t conform to the characteristics of the existing neighborhood. When the rest of the homes are worth $400,000 thousand, it is not smart to build something that should be worth $600,000 because of the cost.

When it comes to home value, you are always better off being the low man on the street. Being surrounded by higher priced homes brings up your value. So many sellers have a hard time understanding how much location can play into a home’s value.

When delivering the unexpectedly lower value, sellers often have a look of astonishment that can sometimes turn to anger. The old sitcom Different Strokes in the 80’s comes to mind when Gary Coleman says “what you talking about.”

Over the years, I have seen numerous sellers make poor financial decisions when it comes to over improving.

As you can see there are a number of appraisal myths that should be ignored. Understanding what effects market value is important whether you are buying or selling a home.

Final Thoughts

When it comes to real estate appraisals, there are many half truths. When you are not sure about something lean on the real estate professionals that are part of your team including your mortgage broker, agent and real estate attorney.

Getting sound advice is often essential when it comes to something as vital as the appraisal.

Additional Useful Home Buying and Selling Resources

- How to buy a house with no money down – get some terrific guidance on how to buy a house with less cash via Luke Skar.

- What should I buy a house or a condo – are you having a hard time deciding between a condominium and a home? Get some advice from via Kyle Hiscock.

Use these additional resources to make solid choices when purchasing or selling real estate.

About the author: The above Real Estate information on appraisal myths too many sellers believe was provided by Bill Gassett, a Nationally recognized leader in his field. Bill can be reached via email at billgassett@remaxexec.com or by phone at 508-625-0191. Bill has helped people move in and out of many Metrowest towns for the last 35+ Years.

Are you thinking of selling your home? I have a passion for Real Estate and love to share my marketing expertise!

I service Real Estate sales in the following Metrowest MA towns: Ashland, Bellingham, Douglas, Framingham, Franklin, Grafton, Holliston, Hopkinton, Hopedale, Medway, Mendon, Milford, Millbury, Millville, Northborough, Northbridge, Shrewsbury, Southborough, Sutton, Wayland, Westborough, Whitinsville, Worcester, Upton, and Uxbridge MA.

Curious, how do brand new manufactured and modular homes fit in with this information. How are Manufactured homes appraised and what is the process? Is the process different from your traditional “site built” homes? Please explain the difference with appraisals regarding manufactured homes and site built please.

Hi Chris – there really is no difference between appraising modular homes vs stick built ones. An appraiser could potentially give a plus or minus to the modular home based on it’s construction quality. There can be significant differences just like in stick built homes from one to the next. Typically if an appraiser can they will compare apples to apples. In other words if there are a number of modular sales in the area they will compare to those rather than stick built properties.