What Are The Unexpected Costs of Buying a Home?

There can be several unexpected costs of buying a home when you have never done it before.

There can be several unexpected costs of buying a home when you have never done it before.

Some first-time home buyers find this out the hard way. Nobody hands you a list of bills to pay when owning a house. There are home buyer costs that will come as a surprise to many.

Buying your first home is undoubtedly an exhilarating experience. You have been imagining home ownership for years and are thrilled to be making it a reality.

When you view your dream home, you begin to envision how great your life will be, and you can’t wait to submit an offer.

There are, however, extra expenses when buying a home. Unfortunately, many first-time buyers forget about them.

One of the best tips for buying your first home is understanding how the purchase will impact your financial health.

This is when you need to take a deep breath. You mustn’t let the excitement of it all cloud your sensibility. You must keep in mind that there will be expenses for first-time home buyers you did not necessarily think about.

It would help if you looked at the complete picture of what this home will cost you. If you account for all these extra home-buyer costs, you can still make it work, start packing, and enjoy your new life in your ideal home.

Unfortunately, extra expenses when buying a home is not always the first thing a first-time purchaser thinks about. Nonetheless it is an important consideration.

We are will examine the costs of buying a house that first-time home buyers should prepare for.

House Expenses List

Below is a summary of all the costs and expenses you should consider when buying a house. These are the ongoing expenses you will have when buying a home.

Home Maintenance

Since this is your first home purchase, you are probably used to a landlord taking care of all of the maintenance involved with your home. You have become used to only making a phone call when something goes awry and then having it fixed with no loss.

As a homeowner, you don’t have this luxury. If something breaks, you have to fix it. You are also in charge of keeping the lawn looking good, which likely means you will need to purchase some new equipment and tools.

You need to ensure you have the budget to set aside some funds each month to cover these unexpected costs. If you are in a cold weather climate and have a long driveway, don’t forget about the need to have someone plow you out when that big snowstorm hits!

Every spring many homeowners will tackle projects around the home as part of a homeownership checklist. These are many of the hidden costs of buying a home that can sneak up on you.

Appliances and Furnishings

One of the most common extra expenses when buying a home that is often forgotten about is appliances!

Unlike rentals, most new or resale homes on the market do not necessarily come with all the appliances included.

Without appliances included, you may have to get yourself a fridge, washer, dryer, and perhaps a microwave before you can move in. Not to mention, you will probably need to get some new furniture to fill your more prominent space.

You can buy most of these items used if necessary, but it will still cost you a pretty penny, and you need to be aware of it.

One of the more significant expenses that many do not think about is the window treatments which can add up quickly.

You are likely going to want to have curtains, at the very least, in the baths for privacy. Window treatments can be far more money than you ever expected, especially if you want something of decent quality.

If you have been living with mom and dad to save money and have never rented a home, then you probably will need to budget for a lot more household items like silverware, glasses, cleaning essentials. You will probably also want some tools, and maintenance equipment like a lawnmower.

,Lastly, don’t forget you will also need to budget for food!

Homeowners Insurance

As a homeowner, you are going to want to protect your investment. You usually don’t have a choice when it comes to homeowner’s insurance.

As a homeowner, you are going to want to protect your investment. You usually don’t have a choice when it comes to homeowner’s insurance.

You often have to show proof that you have it when it comes time to close on your home.

The insurance will protect you in the case of a fire or burglary. If you live somewhere prone to natural disasters (earthquakes, flooding, etc.), you will also want to get additional insurance for those.

There are, of course, ways to reduce your home insurance costs, and this should be something you should seriously consider.

There are some things you can do that are easy to save money. For example, having an insurance carrier for your car that also does your home.

Private Mortgage Insurance

On top of the homeowner’s insurance, if you put less than 20% down on the purchase of your home, you are also going to need to get private mortgage insurance.

PMI protects the mortgage lender you have chosen in case you don’t make your payments (even though you know you will).

The good news is that the premiums for both of the insurances mentioned above can usually be included in your monthly mortgage payment, but that also means your payment will be higher than you initially thought.

Property Taxes

Another thing you don’t have to pay as a renter is a property tax assessment. This annual fee is non-negotiable and usually disclosed on the home listing, so you know how much it will be.

The percentage of tax you will be responsible for will vary based on the state in that you live (with an average of about 1% to 2% of your home’s value).

Again this can vary as there are some states where taxes can take up a much more significant chunk of your hard-earned money.

In most cities and towns, the taxes you will pay will be based on your property’s assessed value combined with the local tax rate.

You can usually choose whether to divide this amount by 12 and include it in your monthly mortgage payment, or you can opt to pay it on your own as a separate bill.

Either way, you need to be prepared for this additional first-time home buyer expense.

HOA Fees

If you are buying a home that has a homeowner’s association, you will need to plan for this expense. An HOA will typically have a monthly bill that is due. The HOA fees can cover serveral expenses including maintenance in the neighborhood.

The fees are likely to be higher if you have perks such as tennis courts, swimming pools, clubhouse or fitness center. When you are buying a condo or townhouse there will be a condominium association. The fees can be similar.

It is also essential to note that you might have an unexpected expense of paying a special assessement. Special assessements are expenses for large expenditures that are not covered by the standard HOA fees.

For example, if all the decks needed to be replaced or the roof of the clubhouse. When there is not enough money in the reserve funds, the owners will share in the burden of these expenses.

UpFront Home Buyer Costs

There are home buyer costs that you will pay for upfront when purchasing a home. Below is a summary of these first-time home buyer expenses.

Earnest Money

The earnest money is the funds you submit to the seller with your offer. It shows the seller you mean business so they can feel comfortable taking their home off the market while the sale processes. Quite often an earnest money deposit is referred to as a “good faith deposit.”

If your offer is accepted, this money gets applied to the down payment or closing costs. If the bid gets rejected, you get this money back. Earnest money is refundable unless you do not follow the contract terms.

It would be best if you planned on having somewhere 1-5% of the price of the home set aside for earnest money. The amount of earnest money collected varies from state to state.

Ensure you ask your buyer’s agent what is customary for your location. In a hot seller’s market the more you can offer, the better. Since the earnest money can be kept by the seller if you default, a higher amount is considered more appealing to a seller.

When there are bidding wars, anything you can do to make your offer more attractive is worthwhile. It is not a good idea to make an offer with a lower amount of earnest money. You will be seen as a more risky buyer.

It is also worth mentioning that when buying a new construction home, the earnest money deposit can be as much as ten percent. Earnest money is a home buying cost to plan for in advance of your purchase.

Down Payment

Thanks to the big housing crash in 2008, it is very rare that you can buy a home without a down payment. You need to prove that you are responsible enough to make your monthly payments, and having a down payment saved up is an excellent way to do so.

For FHA loans, you can get away with a 3.5% down payment, but most mortgages (conventional) would like to see closer to 5- 20% down. In some circumstances you can get a 3 perceent down coventional mortgage.

If you are fortunate enough to buy a home in a rural area, you might also qualify to get a USDA loan. These loans are one of the few no down payment options left, but you can’t purchase in a city or densely populated area to get this type of loan.

If you are serving of have served in the military you can also utilize a VA loan which is a no down payment option. The average down payment for first-time home buyers is around 6%.

It is essential for first-time buyers to do the proper research on the costs of each mortgage to see which is best. There are several first-time buyer mortgage programs to research.

Part of understanding how to get a mortgage is choosing one that offers the best terms.

Closing Costs

If you feel a little overwhelmed by these extra expenses, it’s not over yet. It would be best if you also were prepared to pay the closing costs.

If you feel a little overwhelmed by these extra expenses, it’s not over yet. It would be best if you also were prepared to pay the closing costs.

They cover everything from preparation fees to attorney’s fees (too many other charges that you think are random that do have a purpose).

Unless you can negotiate with the seller to pay the fees, you need to plan on an extra 3-4% of your home’s value to be paid at closing to cover these charges.

One of the first-time home buyer expenses that are often forgotten about is real estate title insurance. Real Estate Title Insurance is a type of insurance that covers financial loss from defects in the title to your property and the invalidity of mortgage liens.

A real estate title policy is put in place to protect an owner’s or lender’s financial interest in a property against loss due to title defects, liens, or other matters.

The insurance will defend against a lawsuit attacking the title as it is insured or pay back the insured for the monetary loss incurred, up to the amount of insurance provided for in the policy.

This is an expense that you should consider as a first-time home buyer.

It is a one-time expense that, if you ever need it, will more than pay for itself. Ask anyone who has ever had to defend a claim without title insurance. It is an absolute nightmare!

Moving Costs

One of the more expensive part of a home buyer’s budget should be moving expenses. Moving is very expensive.

Even if you don’t opt for a professional moving company, you will likely need to rent a moving truck. While hiring a moving professional can cost thousands of dollars, a DIY move is still a healthy expense.

When putting together a house expenses list, many first-timers forget about the moving costs. It is wise to do whatever you can do to save money moving. Follow the tips to bring down your moving expenses.

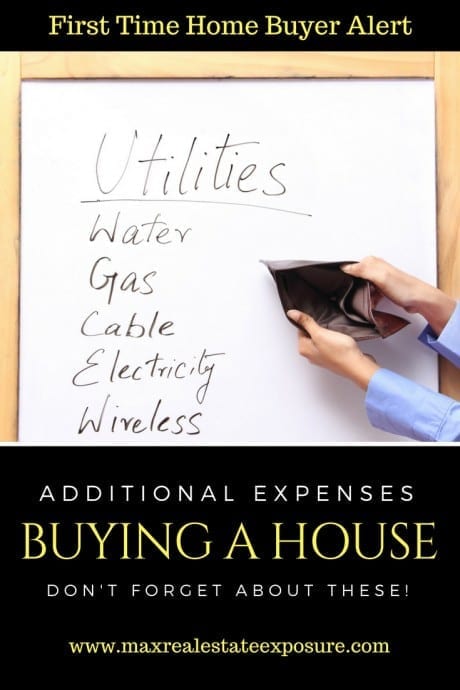

List of Bills to Pay When Owning a House

There are several monthly bills when owning a house. Having a home buyers budget can be helpful to keep track of your on going expenses.

Use this house expenses list as a template of some of the things you likely will be paying.

- Electricity bill

- Heating bill

- Water bill

- Sewer bill

- Phone bill

- Internet bill

- Tax bill

Depending on how ambitious you are it’s also possible you could be paying to mow your lawn or plow your driveway if your in a cold weather climate. Most of these will probably be monthly housing expenses other than the tax bill.

Have an Emergency Fund For Home Buyer Costs

Since there are so many expenses that come with homeownership, it is essential to have an emegency fund as part of your home buyer’s budget. Before committing to buying a home, you should have additional funds socked away in case the worst happens.

You could lose your job or have a health emergency. Keeping funds in case something catastrophic happens is wise.

Final Thoughts on Home Buyer Costs

As you can see, there are some extra first-time home buyer expenses that you may not have thought much about.

It is critical to go into your new home feeling confident you have the financial means to own your first home.

Many home buyers overextend themselves and then get caught in a financial bind. Do yourself a favor and have a healthy reserve in case of emergencies.

You never know when disaster can strike, like losing a job or having some unexpected health issue.

Additional First-Time Home Buyer References

- Questions to ask a mortgage lender – when you’re a first-time home buyer it is essential to ask potential lenders many questions as part of an interview process.

- First-time home buyer mistakes – if you have never purchased a house, it is easy to make errors. See all of the most common mistakes that buyers make and how to avoid them.

Use these additional first-time home buyer references to make a sound home-buying decision. Hopefully, you will also remember these extra expenses when buying a home!

About the author: The above Real Estate information on Home Buyer Costs: Unexpected Cost of a Buying a House was provided by Bill Gassett, a Nationally recognized leader in his field. Bill can be reached via email at billgassett@remaxexec.com or by phone at 508-625-0191. Bill has helped people move in and out of many Metrowest towns for the last 37+ Years.

Are you thinking of selling your home? I am passionate about real estate and love sharing my marketing expertise!

I service Real Estate sales in the following Metrowest MA towns: Ashland, Bellingham, Douglas, Framingham, Franklin, Grafton, Holliston, Hopkinton, Hopedale, Medway, Mendon, Milford, Millbury, Millville, Northborough, Northbridge, Shrewsbury, Southborough, Sutton, Wayland, Westborough, Whitinsville, Worcester, Upton, and Uxbridge MA.